In announcing the results of price negotiations between the Centers for Medicare & Medicaid Services (CMS) and pharmaceutical manufacturers, the federal government has demonstrated that it can replicate private payers’ ability to reduce the net price of treatment while focusing on the clinical benefit of a treatment versus therapeutic alternatives and a host of other factors. Although the reported negotiated prices may ignore the real-world role of contracting by manufacturers and private payers over formulary placement, the reported prices nonetheless are likely to have downstream impacts on how private payers reimburse these therapies and their competitors.

Moreover, the initial set of negotiated prices represents the first step of a process that eventually will reshape the pricing and reimbursement landscape for prescription drugs under Medicare as CMS gradually replaces private payers as the chief negotiating partner for some of the drug industry’s largest-selling treatments. In an added wrinkle, CMS is using the same kinds of analysis private payers use to determine formulary placement of specific therapies, blurring the line between government and private payers.

Announced on August 15, 2024, this first batch of Maximum Fair Prices (MFPs) were mandated by the Inflation Reduction Act of 2022, which allowed CMS to negotiate what it describes as the maximum fair price for therapies representing the greatest cost to Medicare. Price negotiations will be staggered over time, beginning with this initial list of ten Part D drugs that takes effect in 2026 (Part D is the prescription drug coverage component of Medicare, a federal health insurance program for people 65 and older which covers nearly 1 in 5 Americans). These ten drugs cost Medicare Part D nearly $46.8 billion in 2022, the most recent year for which CMS data is available. That compares to the $240.4 billion in spending across all Part D drugs that year (2022) and the $43.6 billion spent on all Part B drugs that same year.

Although the initial set of drugs included for negotiations was limited to ten, the scope of this program will expand over time. In 2025, CMS will select another 15 Part D drugs for negotiations that will take effect in 2027. In 2026, CMS will select up to 15 additional Part B or Part D drugs for negotiations that take effect in 2028, and up to 20 additional drugs every year thereafter (Part B covers physician-administered drugs, including infusions of complex biologics). CMS is targeting those therapies with the greatest Medicare spending, although therapies meeting certain criteria (e.g., drugs more recently approved by the FDA, those with an orphan drug designation for a single indication, or those facing current or looming biosimilar threat) can escape negotiations.

Initial MFPs released show sharp discounts

Set to take effect Jan. 1, 2026, the MFPs negotiated between CMS and drug manufacturers for the initial ten Part D drugs represented on average a 59% discount from their list prices on the dates when the MFPs were published. The discounts ranged from 15% for NovoLog® FlexPen® to 80% for JANUVIA®. The limited discount for NovoLog likely reflects Novo Nordisk’s decision to cut prices by 75% effective Jan. 1, 2024, following an IRA provision capping patients’ out-of-pocket costs at $35 per month.

Figure 1: 30-day price of selected drugs for Part D price negotiations

Source: Red Book, accessed August 13, 2024; CMS

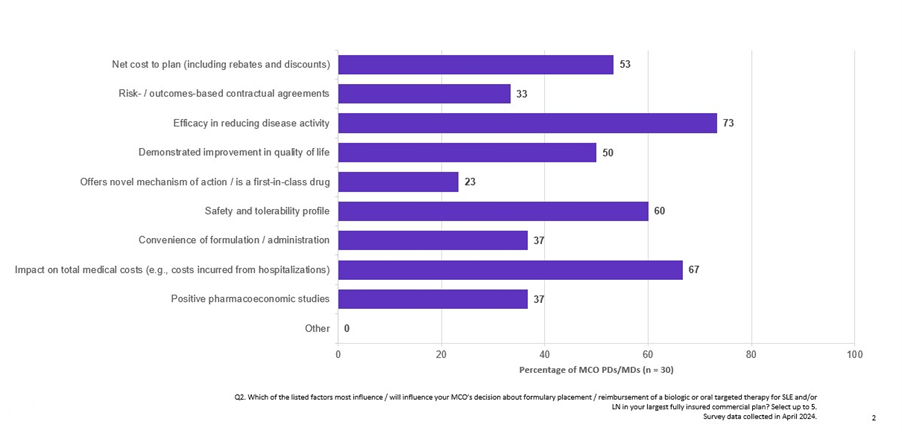

The IRA ordered CMS to consider the extent to which manufacturers have recouped R&D expenses, current production and distribution costs, government support for the drug’s development, and revenue and volume data in its calculations. CMS also weighed evidence regarding alternative treatments to assess therapeutic advancement provided by the drug, comparative effectiveness, and the degree to which the therapy addresses an unmet medical need — attributes also leveraged by the private sector in driving formulary decision-making as reported by surveyed pharmacy and medical directors in Clarivate Access & Reimbursement reports (Fig. 2).

Figure 2: Factors influencing formulary placement and reimbursement of biologic or oral targeted therapy for SLE and/or LN

Source: Clarivate Access & Reimbursement report on systemic lupus erythematosus; survey data collected in April 2024

The commonality between the factors CMS was examining and what private plans already used drew CMS to begin recruiting health economists and others with experience in price negotiations from drug companies and pharmacy benefit managers.

Top-line differences between list price and MFP obscure the impact of discounts and rebates that PBMs and MCOs can secure from manufacturers in exchange for coverage or preferred access. In highly competitive categories like diabetes, net price could be half of the list price. For example, an A&R report for migraine found rebates of up to 30% off list price were common among contracting payers (Fig. 3).

Figure 3: Average rebate ranges for key migraine preventive brands

Source: Clarivate Access & Reimbursement reports, migraine treatments; survey data collected in February, 2024

Payers use these rebates to shape current reimbursement, and an analysis of formulary placement using Clarivate Fingertip Analytics suggest Part D plans were already extracting sizeable rebates for several of these therapies –- plans covering 95% or more standalone Part D beneficiaries had access to ELIQUIS®, JARDIANCE®, XARELTO®, JANUVIA, and ENTRESTO® on a preferred tier, pointing to active contracting between manufacturers and Part D plans. Plans covering 46% and 80% of Part D lives offered similar preferred access to NovoLog FlexPen and FARXIGA®, respectively. The only exceptions were ENBREL®, IMBRUVICA®, and STELARA®, whose high monthly costs — exceeding the threshold of $950 for a 30-day equivalent allowed in calendar year 2024 — allow Part D plans to place them on the specialty tier resulting in patient coinsurance.

Figure 4: Coverage status of key drugs in standalone Part D plans

Source: Clarivate, Fingertip Analytics; data accessed on July 1, 2024

These MFPs partly represent the rebate agreements that already existed between manufacturers and private payers under Medicare Advantage, possibly with even greater discounts. With the MFP in place, the rebates likely will no longer flow at the same level to Part D plan sponsors, which could drive them to change these therapies’ reimbursement status. Payers may consider increased contracting with competitors of the ten selected drugs for preferred access while shifting them to a less-favorable tier, increasing patient out-of-pocket costs.

Figure 5: Coverage status of key drugs in Medicare Advantage plans

Source: Clarivate, Fingertip Analytics; data accessed July 1, 2024

The road ahead for stakeholders

The reported MFP discounts suggest CMS can obtain comparable or better terms than individual Part D or Medicare Advantage plan sponsors. As additional drugs are added to the program, private Medicare payers will lose rebate funding for Medicare-covered drugs and will need to adjust, placing greater attention on products not subject to price negotiations and adjusting reimbursement strategies accordingly. Pharmas may choose to accept these discounts as a standard business cost or revise their strategies to mitigate the risk of being selected for price negotiations.

November’s elections could shape the future direction of drug price negotiations in the U.S. Vice President Harris has indicated she would pursue further policies to lower the burden of drug costs on patients, while former President Trump and his supporters have expressed opposition to the IRA, citing concerns over the climate-related initiatives included in the legislation.

Learn more about how Clarivate helps life science companies navigate a fast-changing market access landscape here.